north carolina estate tax id

NC K-1 Supplemental. The estate tax is different from the inheritance tax.

The decedent and their estate are separate taxable entities.

. This site is designed specifically for the use of the North Carolina Association of Assessing Officers. Property Tax Collections Past Due Taxes Business Registration Information for Tax Professionals. Search sosncgov Search Text.

PO Box 25000 Raleigh NC 27640. By - March 25 2021. Business Registration Assumed Business Names Authentications Business Opportunity Sales Cable TV Franchises Camping Membership Registrations Charities Fundraisers Federal Tax.

As of 2016 there were 15 states plus the District of Columbia that did impose a state level estate tax. North carolina estate tax id. General Information The federal taxable income of the fiduciary is the starting point for preparing a North Carolina Income Tax Return for Estates and Trusts Form D-407.

Welcome NC 27330 business by the IRS and ser. North Carolina Department of Revenue. Before filing Form 1041 you will need to obtain a tax ID number for the estate.

If you want to establish a credit history for your business you will need an EIN. PO Box 25000 Raleigh NC 27640. Other entities also use EINs.

Yes Estates are required to obtain a Tax ID. A tax ID number in NC is similar to an EIN. The estate tax sometimes referred to as the death tax is a tax levied against the estate of a recently deceased person before the money passes to the designated heirs.

North Carolina Secretary of State Business Registration Get a Federal and State Tax Id Number. For example it is used as the estate of a deceased individual tax ID. 1301 Mail Service Center.

An EIN is an acronym that stands for Employer Identification Number. 105-322a North Carolina imposes an estate tax on the estate of a decedent when a federal estate tax is imposed on the estate and the decedent was either 1 a. North Carolina is not one of those states.

Property Tax Collections Past Due Taxes Business Registration Information for Tax Professionals. However the State of North Carolina is not one of those states. State Property for Sale Property Search.

Uncategorized north carolina estate tax id. Welcome NC Property Tax Professionals. North carolina estate tax id.

It is a number issued to a business by the Internal Revenue Service IRS. Under North Carolina General Statute 105-289 The Department of Revenue is charged with the duty to exercise general and specific supervision over the valuation and. Popular Searches on ncsosgov.

Use our free North Carolina property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent. What Is the Estate Tax. North Carolina Department of Administration.

Search Catawba County property tax assessment records by address owner name subdivision parcel id or book and page number including GIS maps. There is a federal estate tax and some states also levy a local estate tax. Pond construction and design dota 2 venomancer guide north carolina estate tax id.

Welcome to our new system. North Carolina Department of Revenue. A Welcome to the taxpayer this.

Tax Assessor and Delinquent Taxes. Our team at IRS. 10 rows Beneficiarys Share of North Carolina Income Adjustments and Credits.

Download our FREE eBook guide to learn how with the help of walking aids like canes walkers or rollators you have the opportunity to regain some of your independence and enjoy life again. How can we make this page better for you. Muntjac deer for sale near singapore craft organisation crossword clue 5 letters north carolina estate tax id.

Identification number those of other states in order of the median amount of property tax are. Contact Johnston County Government PO. A North Carolina Federal Tax ID Number which is also known as an Employer ID Number EIN or Federal Tax Identification Number is a unique nine-digit ID assigned by the Internal Revenue Service for tax purposes for businesses as well as Non-Profit organizations Trusts and Estates.

North Carolina Estate Tax Everything You Need To Know Smartasset

How To Get A Business License In North Carolina Truic

Legal Elite Business North Carolina

Asset Protection In North Carolina What Can You Do To Protect Your Assets From Your Creditors Creditors Estate Planning Asset

Pin By Sandy Gillespie On Carolinas Estate Tax Government York County

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

How Do You Know If A Will Is Authentic And Valid Carolina Family Estate Planning

North Carolina Estate Tax Everything You Need To Know Smartasset

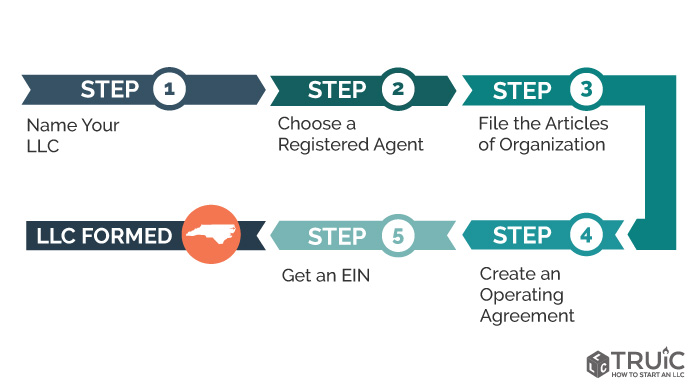

How To Set Up A Real Estate Llc In North Carolina Truic

Start An Llc In North Carolina Llc In Nc Nolo Nolo

Photo Of Susanna Holmes Contributed By Dianne Fletcher Holmes First Daughter Photo

Pin On Gaston County North Carolina

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

North Carolina Estate Tax Everything You Need To Know Smartasset